Filing taxes is mandatory even if you’re self-employed, a freelancer, or a corporation. In the United States, this process involves collecting the Form W-9 from independent contractors who work in your company.

Even if you have the assistance of a professional accountant, filing taxes can be complicated. No one likes the hassle of filling out forms or going through tax jargon.

Don’t worry. This beginner’s guide explains everything you need to know about the W-9 form. Find out who needs to use this financial document, why it’s essential, and how to make the process easier for you.

Table of Contents

- What Is a W-9 Form?

- Who Needs to Submit a W-9 Form?

- Where Can You Get a W-9 Tax Form?

- What If a Contractor Refuses to Submit a W-9 Form?

- How to Fill Out an IRS W-9 Form

- Collect W-9 Forms Instantly With Fill

What Is Form W-9?

The W-9 form is an Internal Revenue Service (IRS) document requesting a taxpayer identification number (TIN) and other vital information such as:

- Legal name

- Business name

- Address

- Social security number (SSN)

- Federal tax classification

Companies and employers use the W-9 form when paying independent contractors. You need to disclose the payments made to external parties to the IRS. All the information mentioned above is necessary to prepare a 1099-MISC at the end of the year.

The 1099 tax form reports the total amount of miscellaneous income that contractors receive at the end of the year.

Who Needs to Submit a W-9 Form?

A US citizen or a resident alien currently receiving payments of $600 or more in the tax year should fill out and submit the form. This includes:

- an independent contractor

- a freelancer

- a self-employed professional

- a consultant

Where Can You Get a W-9 Tax Form?

W-9 forms are available at the (IRS) website. Companies can download it for free and there are no requirements or documents needed. You may ask your contractors to send it to you via email, fax, or courier.

What If a Contractor Refuses to Submit a W-9 Form?

If a contractor refuses to submit the W-9 form, the company who hired them will need a backup withholding of 24 percent. The company will pay that amount to the IRS and include it when filing the form 945. Failure to file the 1099 form is subject to fines ranging from $50 to $270.

Remember, whenever you request for a W-9 form from your contractors, it must be documented in a written format like email.

You can ask contractors to complete and submit the form on the following occasions:

- First request – at the start of the business relationship

- Second request – by December 31 of the year you started working together or by January 31 if you started in the preceding month

- Third request – by December 31 of the following year.

There is no deadline for submitting W-9 form for contractors. However, it’s best to collect it before you file Form 1099.

How to Fill Out an IRS W-9 Form

Filling out a W-9 form may seem complicated. However, doing it section by section is pretty straightforward.

- On line 1, fill out your name as shown on your tax return.

- On line 2, enter your business name.

- On line 3, select the type of federal tax classification and check the appropriate box: sole proprietorship, partnership, C corporation, S corporation, trust estate, limited liability, or other.

- On line 4, check the applicable boxes under Exemptions. Leave them blank if you are not an exempted payee.

- On lines 5 to 6, fill out the boxes with your street address, including the city, state, and zip code. Use the same address on your tax return.

- On line 7, enter the requester’s name and address. This part is optional, but if you want to keep a record of the company requesting your TIN, you may fill this out.

- In Part I, provide your TIN. Self-employed professionals must give their social security numbers, while employees also need to provide an employer identification number (EIN). Fill out the appropriate boxes.

- Part II is an attestation or certification of the truthfulness of the information. Intentional lying about the information you submit in a W-9 form will result in fines or jail time.

Fill Out and Sign Your W-9 Form With Fill

Fill is an electronic signature and online form generator that lets you fill out and sign a W-9 form online. How can you benefit from it?

- Freelancers, independent contractors, and self-employed professionals can upload a W-9 form, fill out the boxes, and sign it electronically.

- Companies can reuse Fill’s default W-9 form to create a new form for each contractor or freelancer. Copy the link and share it with contractors via email or instant messaging.

To get started, register for a free account on Fill. Once you’ve signed in, you will see the main dashboard. Follow the next steps.

How to create a shareable W-9 form

Companies and employers can ask their HR or accounting department to create a shareable form online. This can streamline the way you collect tax information from contractors and employees.

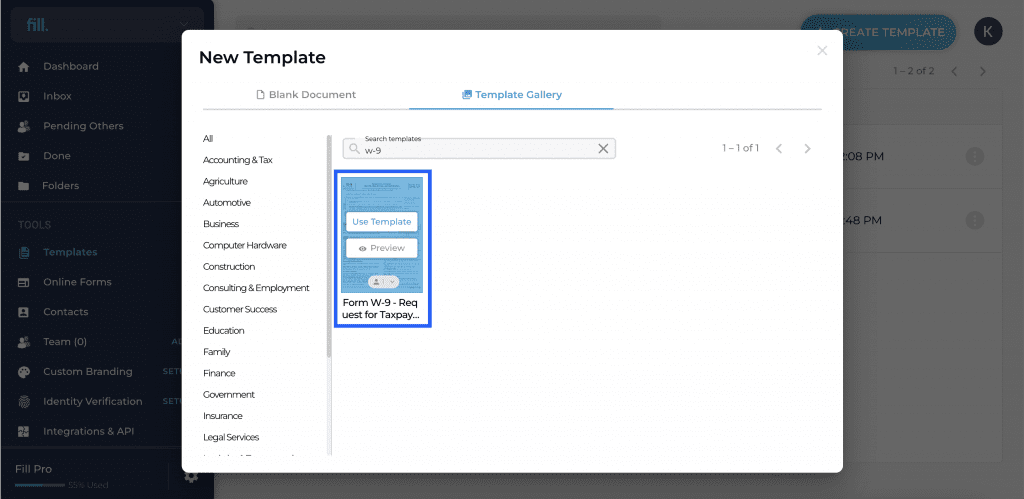

1. Click Templates under Tools, which is located in the left panel.

2. Click Create Template on the upper-right of the dashboard. A drop-down menu will appear. Select From Template Gallery.

3. A window will show up displaying the available templates in the gallery. Type W-9, then click Use Template.

4. Fill will automatically show you the 22 fields you need to fill out. Toggle the online form located on the upper right corner. Create an online form of this template so others can fill it out.

5. On the Fields section, drag and drop the signature element to the signature box. Ensure that other Settings, tick the box that says Required. This means the signer must attach their signature to complete the form. You can also apply this to the Date Signed.

6. Click Create. Fill will save it and click Got it.

7. Go to the Online Forms section in the left panel to see the active W-9 form.

8. Click the form and copy the link. Share it with the recipient.

9. To test how the form would look on the recipient’s end, copy and click on the link. Enter your details as you typically do when answering a form.

How to sign a W-9 form online with Fill

Scroll down to attach your signature and include the date signed.

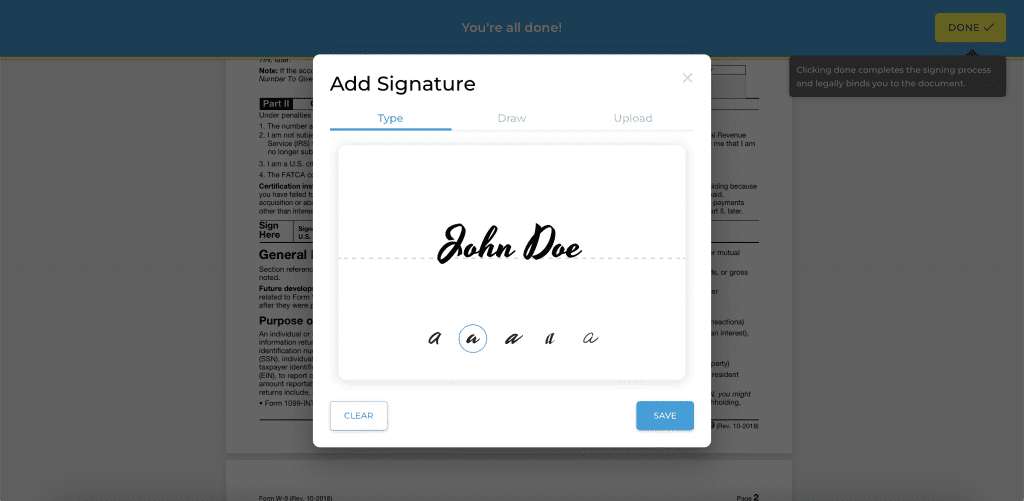

1. Click the Signature field and a window will pop up. You have three options for creating a new electronic signature:

- Type a signature.

- Draw one using your mouse

- Upload an image of your handwritten signature.

2. Here’s how the interface would look like if you choose to type in your complete name or initials.

3. Lastly, click Save. You will receive a notification that the form was successfully signed and submitted.

You don’t need to create a Fill account to complete the process. However, it’s highly recommended to have one so that you can reuse the electronic signature you’ve created.

Collect W-9 Forms Instantly With Fill

You don’t have to email your contractors one by one to remind them about W-9 form submissions. With Fill’s W-9 template, you can send this tax form to multiple recipients instantly. The best part? Fill provides reports the number of views and keeps track of who fills out and signs online.

Plus, you can reuse the form each tax season without having to do manual data entry.

Simply share the form URL via email or instant messaging. If you have an automated emailing system like Klaviyo or Keap, include the link to your year-end email blast.

Curious to see how it works? Register for a free account and create online forms like a pro. No coding or technical skills required.