There are certain things that first-time homebuyers fail to realize when they buy property. One of these things is the fact that homeowners have to take care of taxes for their property.

If you are a new homebuyer, it’s time to learn more about IRS form 8396 creation. This article will guide you through this process.

Table of Contents

How to Write a Form 8396

Let’s get straight to the point and discuss how to create the 8396 form. When you need to fill up the form, the details you need to include are:

- Your name

- The name of the MCC issuer

- The certificate number

- The issue date

- The Social Security Number of the MCC issuer

Essential Elements of Form 8396

Once you have this information, you will need to fill out the form properly. Here are some of the essential elements of form 8396:

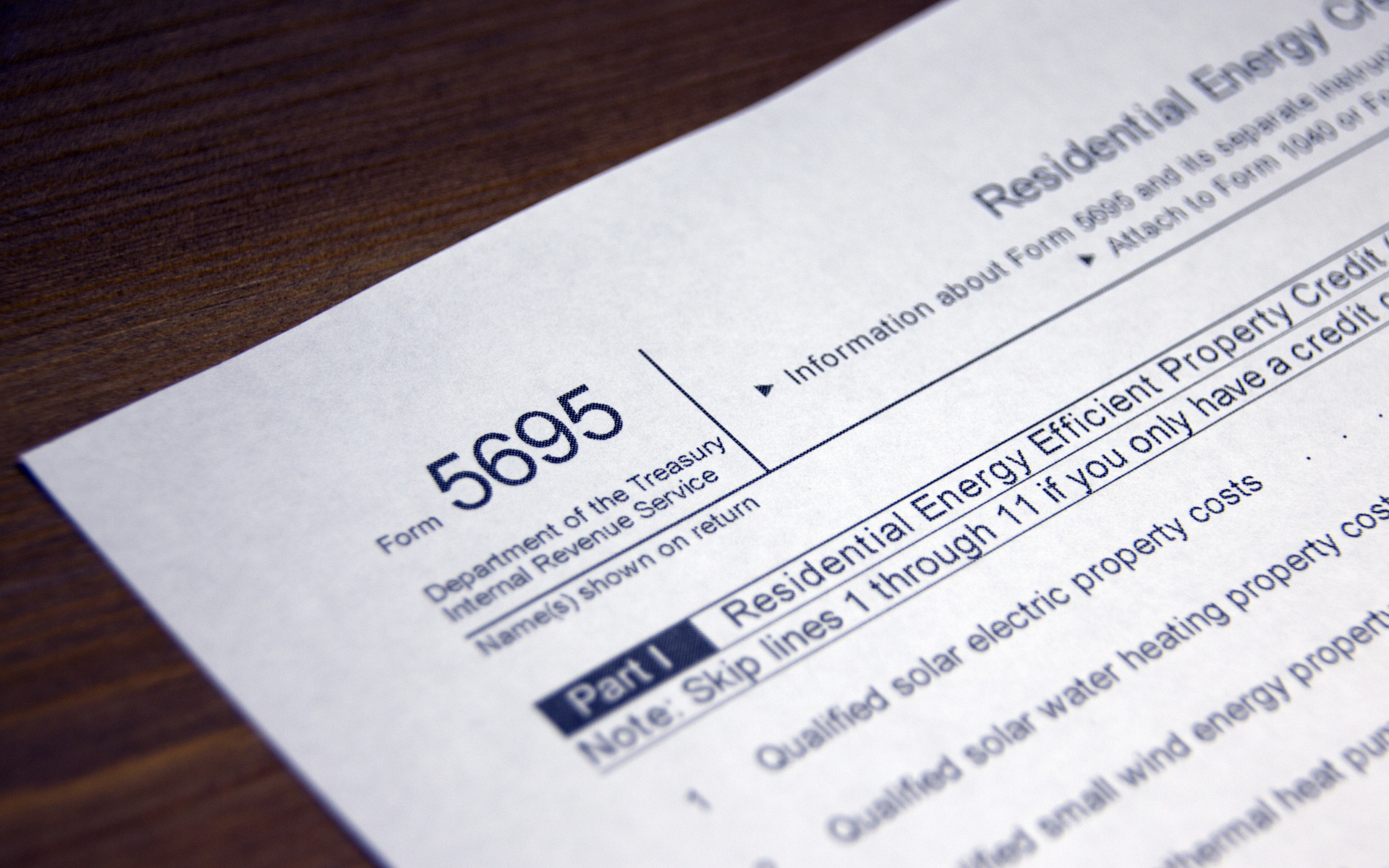

Part I

On Part I of the form, you need to figure out what your mortgage interest credit for the current year is. You can use the MCC to look at the rate for your credit.

- Line 1 – This is where you need to provide the interest amount that you pain on your loan. The calculation should only be based on the loan amount indicated in your MCC. If you don’t have this information, you can look through Box 1 of your IRS form 1098 Mortgage Interest Statement. This can also be found on any other statement that your mortgage holder provides.

- Line 2 – You will need to provide your certificate credit rate. This will need to be between the limits of 10%-50%.

- Line 3 – If you need to refinance your mortgage, you will need to multiply the interest scheduled on the original mortgage you have with the rate on your original MCC. If the rate indicated on Line 2 goes over 20%, you will need to multiply the entered digits on the two previous lines. Remember that you need to stick to the $2,000 limit. If the interest is held with another person, the $2,000 amount should be divided between the two according to the interest held.

- Lines 4-7 – These lines are self-explanatory and will simply require you to enter a credit carryforward from previous lines.

- Line 8 – You will need to indicate an amount on this part that will be determined by the Credit Limit Worksheet. The form comes with the Credit Limit Worksheet that you can use to figure out this amount. The worksheet does not need to be filed with the credit form. You simply need to keep it for your records in the future.

- Line 9 – The amount you indicate on lines 7 or 8 should be repeated here, whichever of these two amounts are smaller.

Part II

Part II of form 8396 is where you can determine the carryover credit for the following year. The succeeding lines under this part (lines 10-17) are pretty self-explanatory.

It’s important to note that the IRS imposes a maximum mortgage interest credit limit of $2,000 per year. If you have any unused credit for the following year, you will need to keep a copy of the form so you can use it for the following year’s credit.

When you’re done writing form 8396, attach it to your individual federal income tax return.

Download the IRS Form 8396

When you are drafting 8396 form, it’s important that you accomplish it properly. This way, you do not make any mistakes in the form and you’ll be able to complete the form in time.

If you are in need of help writing the form, you can sign up for a free account at Fill. There are plenty of templates (including form 8396) that you can use to save you time in creating one from scratch.

Form 8396 – Mortgage Interest Credit

A Brief Overview of IRS Form 8396

In a nutshell, form 8396 is used to calculate their yearly mortgage interest credit. Any carryover credit identified can be allotted for the following year.

The purpose of this mortgage interest credit is to assist lower-income taxpayers be able to afford a home of their own. If you have a mortgage credit certificate (MCC) from your state or local government, you can claim the credit.

This is a different document from form 1098 Mortgage Interest Statement that your bank or financial institution gives out for the mortgage interest you’ve paid.

Best Practices When Writing a Form 8396

When you are learning to fill up form 8396, there are some restrictions you have to consider. These include the following:- The residence needs to meet the specific price and value requirements of the local housing market.

- The connected home in the issued certificate needs to be within the same jurisdiction as the agency issuing the certificate.

- The property must be the primary residence of a tax filer.

- The deduction amount for the claimed mortgage interest must be offset by the amount claimed.