How to Draft Form 8283: Quick Guide With Free Template

Discover how to draft form 8283 quickly and seamlessly with Fill, an eSignature app that features customizable tax forms and robust security features.

Are you looking to donate property to charity and receive a tax deduction? If so, you need form 8283, Non-cash Charitable Contributions. The Internal Revenue Service (IRS) requires this form for any non-cash donation exceeding $500. While it may seem complex, the proper knowledge and tools will help you complete it quickly and accurately.

Fortunately, we've created this guide to walk you through how to draft form 8283. We've also included the document's standard components, common mistakes to avoid, and a free template for you to use. Finally, you'll learn how to use Fill to streamline your tax form creation process.

How to Draft Form 8283: Step by Step

Accomplishing tax forms can be a complicated endeavor. Use this quick but informative guide to learn how to write IRS form 8283 effortlessly:

1. Obtain the form

The first step in drafting form 8283 is downloading the form from the IRS website. You can find this document under the Forms and Instructions section. You may also use Fill's customizable form 8283 template to help you complete the task.

2. Gather information

The next step is gathering all the necessary information to complete the form. These details include the donor's name, taxpayer identification number (TIN), and the. You will also need the contribution date, a detailed description of the property donated, and the property's fair market value at the time of the contribution. Lastly, you must include the recipient organization's name and address.

3. Determine property value

It would be best to determine the property's fair market value at the time of the donation. You can use a qualified appraisal or a valuation method to do this. A certified tax professional can also help you clinch an appropriate value for your donation.

4. Fill out form 8283

Use the information you've gathered to fill out form 8283. Be sure to include all the required details, including the name and address of the organization receiving the donation, the property description, and the property's fair market value.

In the next section, we'll discuss all the elements you need to accomplish form 8283 quickly and seamlessly.

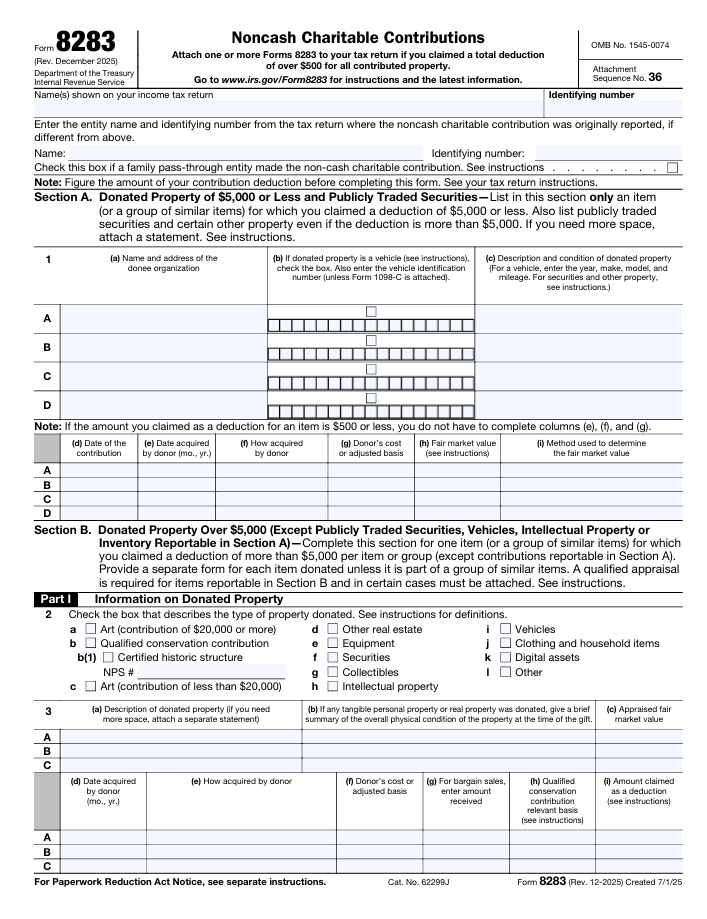

Download Form 8283 Template

Use the free template below to quickly fill out your 8283 information:

Standard Components of a Form 8283

A form 8283 is a two-page document that includes several sections. These are the standard components of an IRS form 8283:

Section A: Donor information

This part requires the donor to provide their name, address, taxpayer identification number, and other details.

Section B: Donee information

This section directs the donee organization to provide its name, address, and taxpayer identification number.

Section C: Description of donated property

This component needs a detailed description of the donated property, including its type, date of acquisition, and cost basis.

Section D: Acknowledgment of receipt of property

The donee organization must acknowledge receipt of the donated property in this part.

Section E: Appraisal summary

This final part requires a summary of the appraisal of the donated property, including the appraiser's name and qualifications.

How to Use Fill For IRS Form 8283 Creation

Now that you understand drafting 8283 tax forms and the standard components, it's time to simplify the process using Fill.

Fill is an eSignature app that makes completing and signing forms online easy. To use Fill for drafting Form 8283, follow these simple steps:

- Log onto the Fill website and select form 8283 from the template gallery.

- Fill in the required fields with your personal and donation information.

Sign and date the form electronically. - Download the document as a PDF for printing.

- Enclose and submit the form with your tax return.

That's how simple it can be to complete Form 8283 with Fill. So, what are you waiting for? Sign up for a 7-day free trial now and make your tax documents a breeze.